The MainGate MLP Mutual Fund: A Synergy of MLP Opportunity and Mutual Fund Convenience

Investment Objectives

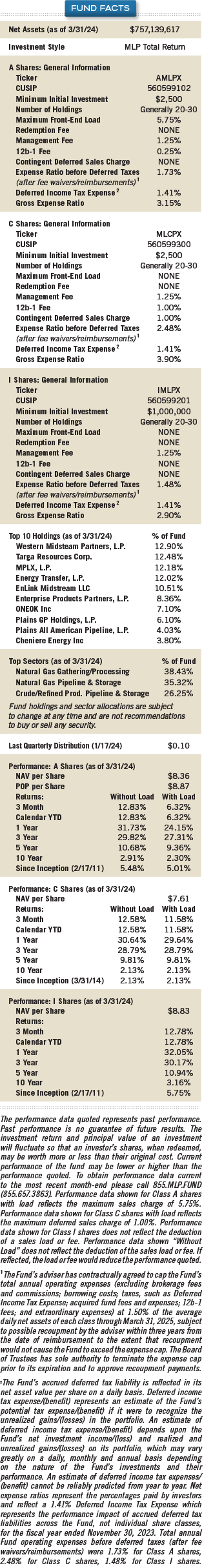

The MainGate MLP Fund is constructed with a Total Return perspective. Chickasaw Capital Management concentrates on MLP interests that it deems attractive in the current market based on a variety of key considerations. Our primary investment objective is total return by pursuing the generation of current income combined with the appreciation of capital.

Fund Benefits

The MainGate MLP Fund offers access to the MLP market with the convenience of implementing a Mutual Fund.

- 1099 tax reporting

- No K-1s

- No UBTI

- MLP sector performance compared to broader equity markets and other asset classes (see Figure MG-1)

- Income and growth potential

- Liquidity, transparency and flexibility of a Mutual Fund

- Inflation-hedging potential

- Qualified retirement plan eligibility

- IRA eligibility

- Portfolio diversification

Capital Gains

Due to the Fund’s "C" corporation tax structure, shareholders receive a 1099 DIV statement that reflects income received and Return of Capital associated with quarterly distributions for the year. There will be no capital gains reflected on the 1099.

Potential capital gain/loss activity from the Fund’s investment portfolio is handled at the Fund level and does not flow to the Fund shareholder via their 1099.

Investment Strategies

Distribution Stability and Growth Profile. Chickasaw Capital Management seeks MLPs that continue their record of achieving earnings growth through operational expansion, rate increases and acquisitions. Recent years have seen many major oil companies divest midstream energy assets, providing an opportunity for MLPs to acquire these assets at attractive valuations — a practice that may in all likelihood continue. Since MLPs tend to distribute the bulk of their available cash to unit holders, Chickasaw Capital Management believes that distributions should continue to increase as MLPs increase their earnings.

Strategic Value of Energy Infrastructure Assets. MLPs in certain industries that operate strategically important assets — such as the pipelines that deliver crude oil, refined products and natural gas — have a history of generating stable and predictable cash flows. Chickasaw Capital Management believes that the fee-based models of MLPs such as these — which are unrelated to commodity prices — combined with the long-term importance of their midstream energy assets, may position these MLPs to generate stable cash flows throughout economic cycles due to the inelastic nature of demand. MLP product pipelines tend to be regulated by federal and state authorities to ensure that rates are fair, which may include inflationary rate increases that provide an environment for highly predictable cash flows.

Position Within the MLP Sector. Chickasaw Capital Management typically seeks well-established MLPs with more significant asset bases and operations as these may enjoy a competitive advantage over other entities seeking to enter the market. Due to the many challenges involved in creating new rights-of-way, the lower cost of expanding rather than constructing new assets, not to mention the complexities involved in regulating such assets, the barriers that must be overcome to gain entry to the midstream energy sector are relatively high. This being said, Chickasaw Capital Management would remain mindful of smaller, less-seasoned MLPs should our research and evaluation processes present a clear and present opportunity to achieve the overall investment objective of the Fund.

Inefficient Market Conditions. Because of a lack of broad institutional ownership and in-depth research, the market for MLPs is often inefficient, an opportunity which the Fund will seek to exploit. Historically, there has been a lack of MLP ownership for many institutional investors. Because MLPs often generate unrelated business taxable income, tax-exempt investors such as pension plans, endowments, employee benefit plans, and individual retirement accounts have not traditionally been MLP investors. Because of the perceived tax-reporting burdens and complexities associated with MLP investments, MLPs have historically appealed only to certain retail investors. Chickasaw Capital Management believes that due to this limited focus, the market for MLPs can experience inefficiencies which we will seek to exploit.

__________

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice.